Insurance coverage carriers intend to see shown liable actions, which is why traffic accidents as well as citations are consider identifying cars and truck insurance coverage rates - cheap car. Bear in mind that directs on your certificate don't stay there for life, yet for how long they remain on your driving record varies relying on the state you stay in and the extent of the crime.

For example, a brand-new sports automobile will likely be more costly than, state, a five-year-old sedan (insure). If you pick a lower insurance deductible, it will certainly cause a greater insurance policy bill which makes selecting a greater deductible feel like a pretty great offer. A higher insurance deductible might imply paying even more out of pocket in the event of an accident.

What is the ordinary car insurance expense? There are a wide array of elements that influence just how much car insurance coverage costs, which makes it difficult to get an accurate concept of what the ordinary individual pays for car insurance policy. According to the American Car Organization (AAA), the average expense to guarantee a sedan in 2016 was $1222 a year, or around $102 each month.

insurers credit score low-cost auto insurance auto insurance

insurers credit score low-cost auto insurance auto insurance

Nationwide not just offers affordable rates, however additionally a variety of discounts to help our participants conserve a lot more. How do I get cars and truck insurance policy? Obtaining a car insurance coverage estimate from Nationwide has actually never ever been much easier (insure). Visit our cars and truck insurance coverage quote section and enter your zip code to start the auto insurance coverage quote process.

cheapest car insurance car perks auto

cheapest car insurance car perks auto

Your very own costs may differ. The quickest method to locate out exactly how a lot a car insurance policy would certainly cost you is to utilize a quote calculator tool.

The Basic Principles Of How Much Is Car Insurance? - Liberty Mutual

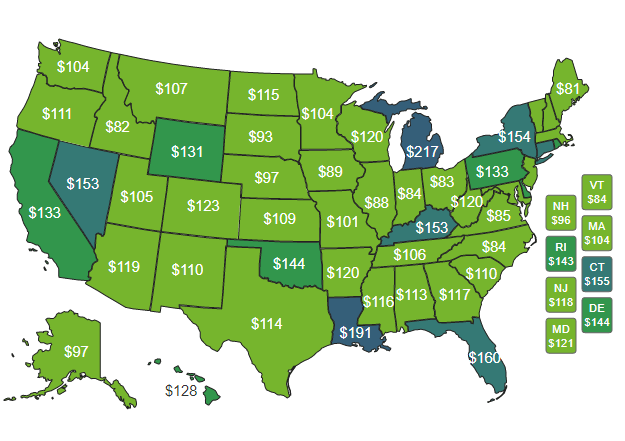

Various states additionally have different driving conditions, which can influence the price of automobile insurance coverage. To provide you some suggestion of what chauffeurs in each state spend yearly on vehicle insurance policy, the table listed below programs the ordinary expense of car insurance coverage by state, according to the 2021 NAIC Auto Insurance Database Record.

Packing: Bundling your home and automobile insurance policy policies commonly causes costs discount rates - affordable auto insurance. You can likewise save money for guaranteeing numerous vehicles under the exact same policy. Paying upfront: Many insurance firms supply a pay-in-full price cut. If you have the ability to pay your entire premium at as soon as, it's typically a more economical alternative.

Our methodology Because customers count on us to offer unbiased as well as accurate details, we created an extensive ranking system to develop our rankings of the very best auto insurance coverage companies. We gathered information on loads of automobile insurance coverage carriers to grade the companies on a vast array of ranking factors. The end result was an overall rating for each and every service provider, with the insurance firms that scored the most factors covering the list.

Schedule: Automobile insurance companies with higher state availability and also couple of qualification demands scored greatest in this classification. Coverage: Companies that use a selection of options for insurance protection are a lot more most likely to satisfy consumer needs. Expense: Typical automobile insurance policy rates and also discount chances were both taken into consideration.

6 Easy Facts About Average Cost Of Car Insurance (2022) - Quotewizard Described

Average Car Insurance Prices by Protection Level When it comes to protecting your automobile, we understand that every person's needs are different. This is also one of the reasons why the typical cost of vehicle insurance differs between customers.

affordable car insurance low cost cheap cheaper cars

affordable car insurance low cost cheap cheaper cars

For example, a policy that will pay for property damages as much as $50,000 will certainly have a higher premium than one that only spends for repair work up to $25,000. Typical Cars And Truck Insurance Coverage Rates by Age Your car insurance coverage prices will certainly also differ based on your age. cars and truck insurance policy firms typically think about young chauffeurs, like teens, to be even more of a risk behind the wheel.

Automobile insurance is generally extra pricey for guys than women. 3 The longer you have actually been driving and the older you obtain, the cheaper vehicle insurance policy prices tend to be. Ordinary Cars And Truck Insurance Coverage Prices by State The typical vehicle insurance coverage rate by state varies. cheap. According to the Insurance Coverage Information Institute (III), Iowa has a few of the cheapest car insurance coverage in the nation at $674, while Louisiana had some of the most costly at $1,443.

At What Age Is Automobile Insurance Cheapest? Generally, automobile insurance costs expense extra for drivers who are more youthful than 25. 5 That indicates as a driver ages and also obtains even more experience when driving, their rates will likely reduce. 6 For some people, these prices can start to raise once again after the age of 65 when you're taken into consideration a senior.

Which Age Pays the Most for Auto Insurance coverage? Insurance coverage firms commonly charge extra for drivers that are under the age of 25. 7 If you are half a century or older, you satisfy the AARP participant age requirement and can obtain protection with The Hartford. Considering that 1984, The Hartford has aided nearly 40 million AARP participants obtain the automobile insurance coverage they require via special advantages as well as price cuts What State Has the most affordable ordinary cars and truck insurance coverage rates? According to III, in 2017, these states had several of the least expensive auto insurance rates:8 For more information, get a quote from us today.

The smart Trick of Florida Kidcare - Offering Health Insurance For Children From ... That Nobody is Talking About

They'll help you obtain the auto policies you need, whether it's to assist spend for problems after a crash or to protect you from accidents with without insurance drivers. cheaper auto insurance.

In enhancement to the insurance firm you choose, factors such as your age, car make as well as version, and driving history can affect your costs, so what's best for your neighbor might not be best for you. How Much Does Automobile Insurance Policy Expense?

Prior to we actually get into the factors that can impact a costs, let's check out some average settlements just based on low or high levels of coverage. Normally, getting the minimal responsibility insurance coverage is less costly than a full coverage plan. Nonetheless, it might be best to pay for more insurance coverage instead than spend for high repair costs down the line.

As an example, boys usually obtain greater quotes than girls due to the fact that researches by the Insurance policy Institute for Highway Safety and security reveal even more boys wind up in crashes. Similarly, a study by the Consumer Federation of America found that older women crash extra frequently than older males, meaning that ordinary car insurance policy payments for older women can be somewhat greater.

The majority of insurance coverage business take your credit history score into factor to consider when identifying how much you will certainly pay for auto insurance. Vehicle insurance coverage firms in some cases change prices according to your work.

Get This Report on How Much Is Car Insurance Per Month In 2022? Get Tips For ...

New automobiles cost even more to change in the occasion of a complete loss, so crash protection is extra costly. Every automobile on the market goes via the safety and security score process. Automobiles with high safety and security scores provide a lower chance of significant injuries, indicating your insurance business will certainly have less clinical bills to pay (insurers).

If your cars and truck invests a lot of its time in a Check over here garage, then your rates might wind up reduced. Your insurance deductible can likewise affect just how much your auto insurance policy premium prices. Just How Much Is Auto Insurance Coverage For Various Ages And Also Genders? As we mentioned, a motorist's age as well as sex can considerably influence average automobile insurance coverage repayments.

These divisions likewise choose exactly how insurance policy companies examine risk and identify ordinary cars and truck insurance coverage prices for state residents. With that said being claimed, many states require that all motorists bring specific amounts of obligation vehicle insurance policy. Numerous states run a no-fault system, meaning vehicle drivers' insurer are responsible for any injuries and residential or commercial property damage no matter of mistake, to make sure that affects needed insurance coverage also. car insurance.

As a result of this, prices differ substantially from one person to another (car insured). This is why we recommend getting quotes from numerous insurer. The tool below can aid with that. Keeping that being stated, numerous of the above-listed firms use affordable prices. We recently looked into the finest automobile insurance coverage business in the nation.

As you can see from the information, USAA cars and truck insurance coverage has some of the most affordable average prices in the industry by far. This, together with its excellent customer support, makes it one of our leading options for car insurance. However, USAA is only readily available to present as well as previous armed forces as well as their relative.

Little Known Facts About Car Insurance Prices - State Farm®.

Methodology In an initiative to supply exact as well as objective info to customers, our professional review team collects data from lots of automobile insurance coverage providers to develop positions of the most effective insurance companies. Companies obtain a rating in each of the complying with classifications, as well as an overall weighted rating out of 5. cheapest car.

Among the biggest elements for customers looking to acquire car insurance coverage is the price. Not just do costs vary from firm to firm, yet insurance costs from state to state differ. According to , the average annual cost of auto insurance in the United States was $1,633 in 2021 and is projected to be $1,706 in 2022 (money).

Ordinary prices vary widely from one state to another (laws). Insurance prices are based on numerous standards, including age, driving history, credit rating, the number of miles you drive per year, lorry type, as well as a lot more. Depending on average cars and truck insurance costs to approximate your cars and truck insurance coverage costs might not be the most exact means to identify what you'll pay.

, and you might pay even more or less than the typical driver for protection based on your threat profile. Younger vehicle drivers are generally extra likely to get into a crash, so their costs are commonly greater than average.

Keeping the minimum amount of insurance your state requires will certainly allow you to drive legitimately, and also it'll set you back less than complete protection. It may not provide adequate defense if you're in a mishap or your car is damaged by an additional covered event (cheap insurance). Curious concerning just how the typical cost for minimum insurance coverage compares to the expense of full coverage? According to Insurify.

Facts About Humana: Find The Right Health Insurance Plan - Sign Up For ... Revealed

car insurance liability cheaper car insurance cheapest car

car insurance liability cheaper car insurance cheapest car

However the only means to understand exactly just how much you'll pay is to shop around and also obtain quotes from insurers. Among the aspects insurance companies make use of to determine rates is location. Individuals that live in areas with greater theft rates, accidents, and also all-natural disasters generally pay even more for insurance. And also because insurance policy legislations as well as minimal coverage needs differ from state to state, states with greater minimum requirements typically have higher ordinary insurance coverage expenses.

Most but not all states allow insurance provider to utilize credit history when setting prices. Generally, applicants with reduced scores are much more likely to sue, so they typically pay more for insurance than chauffeurs with greater credit report. If your driving record includes crashes, speeding up tickets, DUIs, or various other violations, expect to pay a higher costs.