If you determine to carry only obligation insurance coverage, which secures you on the occasion that you injure somebody or their building with your automobile as well as they sue you, then a deductible won't apply (cars). If you're lugging both comprehensive and accident protection, you'll require to select one deductible for every, as well as they can be different quantities.

That implies you need to provide serious factor to consider to what you can deal with monetarily if you had to pay your deductible for either comprehensive or crash insurance coverage. Is $500 all you can manage to cover?, play around with the insurance deductible amount and also see what it does to your premiums.

Whether you're a brand-new vehicle driver or have actually lagged the wheel for years, it can be daunting to wade through insurance terms like "deductible - car." Your vehicle insurance policy deductible impacts the cost of your insurance policy, so it is very important that you select one thoroughly. The deductible that's right for you depends upon your individual scenarios.

How does a deductible job? A deductible is the amount of cash you pay out of pocket before your insurance policy protection kicks in as well as begins paying for the expenses of your loss.

Not all insurance policy protections call for a deductible, however if yours does, you'll select the amount. Your insurance deductible will certainly impact your month-to-month insurance coverage settlement the lower your deductible, the greater your cars and truck insurance costs. When searching for quotes from automobile insurance policy firms, trying out exactly how various deductibles will influence your monthly repayments.

The 10-Second Trick For Car Insurance Deductibles: Choosing Well - State Farm®

Auto insurance coverage can consist of different kinds of coverage that serve differing purposes, and you can choose to be covered by some or all of them. Some of these protection alternatives need deductibles and some do not, so it deserves noting what deductibles you'll be needed to pay. State regulation usually figures out whether or not an insurance deductible is called for.

This covers you if your car hits one more vehicle or things and also you need to pay for repair work. Accident deductibles are conventional but vary by insurance company. If your lorry is damaged by an event such as fire, a dropping object hitting your windshield or vandalism, you'll submit a detailed protection insurance policy case.

If the other chauffeur in a mishap is at mistake however they aren't insured or do not have enough coverage to spend for your building damage, this sort of insurance coverage will certainly concern the rescue. Deductibles are sometimes required for this protection, yet not always, and demands vary by state. While your car insurance policy deductible can vary substantially relying on several variables, consisting of how much you intend to pay, cars and truck insurance deductibles normally range from $100 to $2,500.

When picking a deductible, you'll need to take into consideration several variables, including your budget plan. Invest some time determining just how much you can pay for to spend for a deductible and also exactly how much you'll save money on your month-to-month premiums by selecting a higher one. Ask yourself these inquiries when picking a deductible quantity.

If you obtain in a crash, can you pay for the insurance deductible or would certainly you have a hard time to pay it? Taking on a high deductible may not make much feeling if it stands for a large part of the car's worth.

Get This Report on How Does A Car Insurance Deductible Work? - Quotewizard

Preserving cars and truck insurance policy coverage is one job, but filing a case as well as taking care of the cost of repair services from an at-fault accident is one more - cheaper auto insurance. Yet what happens if you can't pay your cars and truck insurance policy deductible? Continue reading to discover about auto insurance coverage deductibles and just how you can build your plan to fit your needs and budget, even after entering an accident.

We suggest obtaining numerous quotes to locate the best prices as well as deductibles. Enter your zip code to obtain begun or call our group at.: What Is A Car Insurance Coverage Deductible?

If you have a $500 insurance deductible, you must pay that quantity before the insurer covers the continuing to be $1,500. low cost auto. Nonetheless, if you have a $500 deductible however your vehicle repair work prices are just $400, that implies you'll have to pay the total of repair work without the car insurer's aid.

Shields your automobile against damage from things aside from a collision, like fire, theft, criminal damage, severe weather, as well as animals. Since it tends to have lower costs, you might escape picking a low deductible - cheapest car. Spends for damages to your vehicle that were the outcome of an accident with one more auto.

Individual injury protection and also uninsured/underinsured driver protection may likewise have deductibles. Talk with an insurance coverage agent to discover just how to select your insurance deductible and auto insurance costs prices for these insurance coverages based upon your state's rates. What Takes place If You Can't Pay Your Deductible? When paying an insurance policy claim, your insurance firm will typically compose you a look for the amount it's responsible for covering. insurers.

Do I Pay A Deductible If I Hit A Car? - Clearsurance Fundamentals Explained

Below are some steps you can take if you can not manage to pay your insurance deductible: It might be worthwhile to speak to your mechanic about settlement alternatives after a mishap. You may be able to negotiate with the mechanic to forgo your insurance deductible or for a settlement plan. If you choose to take your vehicle insurance coverage check to an additional service center, it can mean cheaper repair services - vehicle insurance.

Waiting to sue is not uncommon, however it is advised to submit a claim as promptly as feasible. auto. When a vehicle insurance coverage repair service is urgent, securing a funding may be the finest choice. It will likely get you, your lorry, and various other celebrations included back when driving earlier.

cheap insurance cars cheapest car insurance liability

cheap insurance cars cheapest car insurance liability

If you merely do not have the funds for the full repair work, attempt starting with the most important or essential repairs, then service the rest in time as you have the funds to cover them. The quantity of time you need to pay your deductible depends on the service center you select.

Will Deductibles Affect Your Premium? Your automobile insurance deductible is exactly how you share the duty to cover losses with your insurance coverage business.

If you are not at fault in a crash as well as another vehicle driver strikes you, you might not have to pay your insurance deductible. It's not ideal to attempt to obtain out of paying a vehicle insurance policy deductible.

Little Known Questions About What Is A Car Insurance Deductible And How Does It Work?.

Enter your postal code or phone call to get car insurance coverage quotes from companies in your area: Geico is one of the largest insurers in the country with a solid sponsorship and also the goal to save vehicle drivers the most amount of money. It uses competitive auto insurance rates for its 6 common insurance protection choices (laws).

There are many available discounts, including those for security functions on your vehicle, going paperless, as well as paying your premium completely. Progressive has a very easy quote process, which allows you to compare various other auto insurer precisely its website. Modern received 4. 5 celebrities in our extensive evaluation. Find out more in our complete testimonial of Dynamic insurance.

Deductible specified An insurance deductible is an amount of money that you yourself are in charge of paying toward an insured loss. When a disaster strikes your home or you have a car accident, the quantity of the insurance deductible is subtracted, or "subtracted," from your case settlement. Deductibles are the method which a threat is shared between you, the insurance policy holder, and also your insurance firm. vehicle insurance.

automobile cheaper car insurance insurance company low-cost auto insurance

automobile cheaper car insurance insurance company low-cost auto insurance

A deductible can be either a specific buck quantity or a portion of the complete quantity of insurance coverage on a policy. The amount is developed by the terms of your insurance coverage as well as can be discovered on the declarations (or front) web page of common homeowners as well as car insurance coverage. State insurance laws strictly determine the method deductibles are included right into the language of a plan and just how deductibles are carried out, as well as these laws can vary from state to state.

In the occasion of the $10,000 insurance loss, you would certainly be paid $8,000., the insurance deductible uses each time you submit a case. The one significant exemption to this is in Florida, where cyclone deductibles especially are applied per period rather than for each storm.

About When Do I Need To Pay A Deductible On My Car Insurance?

accident cheapest car auto cheapest auto insurance

accident cheapest car auto cheapest auto insurance

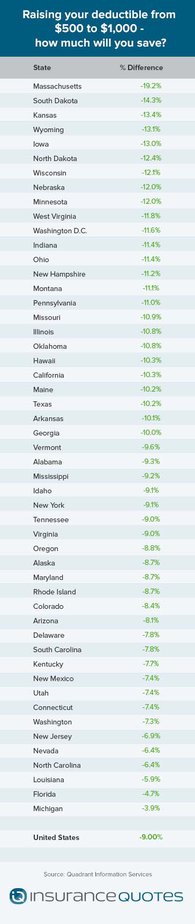

To Go to the website make use of a a homeowners plan instance, an insurance deductible would apply to residential property harmed in a rogue barbecue grill fire, yet there would certainly be no insurance deductible versus the obligation portion of the policy if a burned visitor made a clinical case or filed a claim against. Raising your insurance deductible can save money One means to save cash on a home owners or vehicle insurance coverage policy is to increase the deductible so, if you're looking for insurance, inquire about the choices for deductibles when contrasting policies.

Going to a $1,000 insurance deductible may conserve you even much more. A lot of homeowners and also tenants insurers supply a minimum $500 or $1,000 insurance deductible.

In some states, policyholders have the alternative of paying a higher costs in return for a traditional buck deductible; nonetheless, in risky coastal locations insurers may make the percentage deductible mandatory. operate in a similar way to hurricane deductibles and also are most usual in locations that generally experience serious hurricanes and also hailstorm.

Wind/hail deductibles are most generally paid in portions, normally from one to 5 percent. If you haveor are considering buyingflood insurance policy, make certain you comprehend your insurance deductible. Flood insurance coverage deductibles differ by state and insurance coverage business, as well as are readily available in buck amounts or percents. In addition, you can pick one deductible for your residence's structure and one more for its components (note that your home mortgage company might require that your flood insurance coverage deductible be under a certain amount, to help ensure you'll have the ability to pay it).

Insurance companies in states that have greater than typical threat of quakes (for instance, Washington, Nevada as well as Utah), typically set minimum deductibles at around 10 percent. In The golden state, the standard The golden state Quake Authority (CEA) policy includes a deductible that is 15 percent of the substitute expense of the primary home structure and starting at 10 percent for additional coverages (such as on a garage or various other outbuildings) (cheap).

An Unbiased View of What Is A Deductible In Car Insurance? - Fox Business

Learn what an automobile insurance policy deductible is and also exactly how it impacts your cars and truck insurance policy coverage. The trick is knowing what deductibles and insurance coverages are as well as exactly how they impact auto insurance policy.

What is a deductible? Simply put, a deductible is the quantity that you concur to pay up front when you make an insurance policy claim, while the insurance provider pays the remainder up to your insurance coverage limitation. When choosing your auto insurance policy deductible, think of just how much you agree to pay of pocket if you require to make a case.

It actually boils down to what makes you one of the most comfortable. car. Vehicle insurance plans normally consist of a number of kinds of protections. Since insurance laws vary from state to state, the complying with information is below to give you a wide introduction of normal insurance coverages, and it isn't a statement of contract.